You may have heard the phrase, "Starting something is not as important as finishing it."

This axiom holds true for virtually every element of life - whether it's physical, emotional, spiritual, personal or professional.

However, "finishing" is one of the last things that entrepreneurs and business founders consider when starting a business and running it. They typically don't give much thought to succession planning untilthey're ready to retire.

Entrepreneurs - great at business planning, lousy at succession planning

In fact, a study conducted by Wilmington Trust found that nearly 60percent of privately held businesses have not even considered succession planning.Additionally, astatistic from Wisconsin-based estate planning firm, the Walny Legal Group, found that 60-70 percent of small business owners want to pass their operations on to their progeny, but less than 15 percent ever do.

The Wilmington study also found that owners who have considered an exit strategy for themselves want to ensure the following three priorities are addressed during any transition:

Making sure the company remains viable in the long run.Ensuring that employees continue to have jobs and a future with the organization.Continuing to seamlessly meet customers' needs without any disruption of delivering products or services.Given these needs and thelack of succession planning for more than 8-out-of-10 owners, what options does a founder have for something they've spent all their life building?

Sale of the business in partor in full

If no one in the owner's family wants to run the business, selling all or part of itis usually the first exit strategy that comes to mind for most business owners since it's the most obvious option. However, timing is a critical factor for this strategy, and selling now does not appear to be the best time.

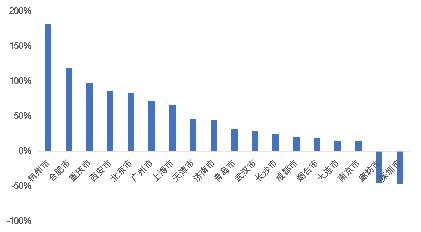

According to the 2020BizBuySell,68 percent ofsurveyed business owners believe they would have gottena better value if they had sold in 2019 compared to 2020, which is nearlydouble the response percentagefor the 2018survey - and 7-out-of-10owners blame the pandemic for their lower estimates in business value.

Business closure or asset liquidation

Small businesses that have been able to pivot, re-invent themselves and surviveduring the pandemic have been gobbling up struggling competitors, distressed assets at deep discountsand the corresponding market share.

It's definitelya buyer's market for small-to-medium-sized companies trying to stay open through the pandemic cycle.TheBizBuySell survey found that 57 percent of prospectivebusiness buyers believe they can now acquirea business for a better value than the same time last year, that's adramatic jump from 17 percent in 2019.

Additionally, closure and liquidation at fire sale prices could be difficult for owners to consider in light of the impact to their lifelong work as well astheir aforementioned priorities of keeping the company running, keeping workers employed and customers happy.

Employee-owned alternatives

However, there is anotherowner exit strategy that increases the chances of keeping the company operational, keeping employees on the job, maintainingbusiness continuity for customers as well as providing atidy ROI to the founder – conversion to an employee ownership model. The most popular employee-owned options include either an employee stock ownership plan (ESOp) or a worker cooperative model.

Employee-owned corporations are companies wherethe majority stake is held by the“rank and file” workers.For either an ESOp (pronounced EE-sop) or worker cooperative, the purchase of the owners' shares of stock on behalf of theemployees is accomplished by a loan underwritten with the company's assets and future profitability.

58003 Shares of stock are allocated to employee accounts in the trust each year, and the allocation formula is typically based on their wages and/or years worked.The value of the shares in an employee’s account increases or decreases each year based on profitability and overall market conditions.

58003 Depending on the plan design, the money from the purchase goes to the employee in a lump sum or equal payments over time. Once the company purchases the shares and pays the employee, the company can redistribute the shares to the remaining employees.

In a worker cooperative, in addition to the corporate loan usedin an ESOpto get it going, there is also normally a small financial buy-in by each "worker owner." This buy-in gives the worker cooperative its distinct “1 share, 1 vote” characteristic, which provides more democracy within the workplace than most ESOps.A focus on the annual sharing of profits rather than the allocation of additional shares of stock is also a unique feature of worker cooperatives.

58003

金融价值网

金融价值网